salt tax deduction limit

While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for married taxpayers filing.

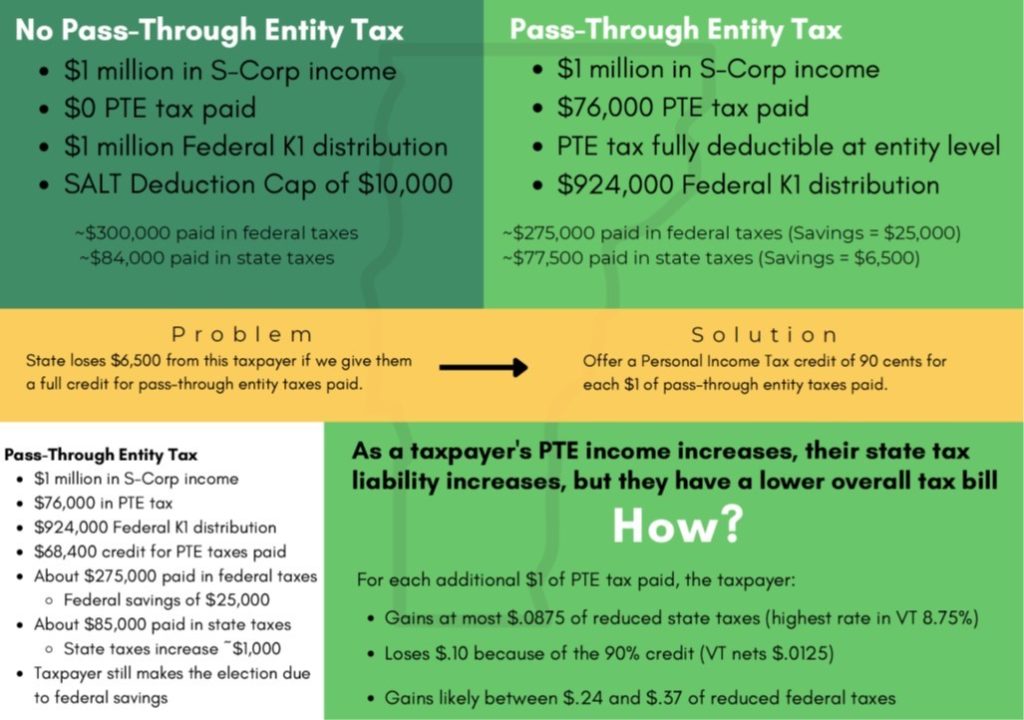

A Salt Cap Workaround Would Have Vermont Pay Less In Federal Tax

The 10000 limit on SALT deductions has a significant measurable revenue impact affecting the federal budget.

. Changes to the State and Local Tax SALT Deduction - Explained The new tax law caps the state and local tax deduction at 10000. Malinowski argued that those who wouldnt directly benefit from lifting the SALT cap. Lets break down how it impacts taxpayers.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples. This means you can deduct no more than.

In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the. There is talk that the SALT deduction limit will be. The 10000 SALT limit may prove burdensome for many taxpayers.

While the standard deduction in 2017 was 6350 for single filers or 12700 for couples filing jointly its now 12000 or 24000. The SALT deduction cap threatens our ability to keep making those investments she said. 115 - 97 imposed a 10000 cap on the deduction for aggregated SALT income tax sales tax real property tax.

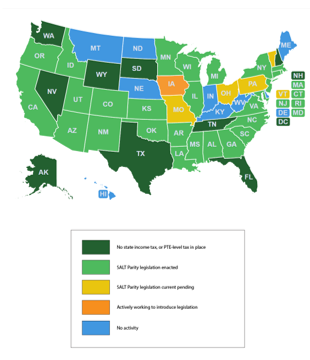

Taxpayers can either take the standard. Prior to the limits enactment the cost in lost revenue for. May 14 2018 How New York State Responded to The SALT Deduction Limit While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual.

House Democrats spending package raises the SALT deduction limit to 80000. Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. Because of the limit however the taxpayers SALT deduction is only 10000.

This deduction is a below-the-line tax. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The Tax Cuts and Jobs Act of 2017 TCJA limits an individuals deduction for state and local taxes SALT paid to 10000 5000 in the case of a married individual filing a.

Second is New Jerseys longstanding 10000 cap on deducting. However for some taxpayers there may be legitimate ways to plan and do the Limbo to come in under the 10000 limit. 52 rows As of 2019 the maximum SALT deduction is 10000.

Spouses and the State and Local Tax Deduction Spouses Filing Separately For spouses that file separate tax returns the SALT deduction is limited to 5000 per person. The first is the new 10000 limitation on deducting state and local taxes also called SALT on your federal income tax return. The law known as the Tax Cuts and Jobs Act TCJA PL.

S Corp Workaround For Salt Deduction Cap Wcre

Utah State Tax Benefits Information

A Salt Cap Workaround Would Have Vermont Pay Less In Federal Tax

Avalara Automated Sales Tax Software Tax Software Automation Software

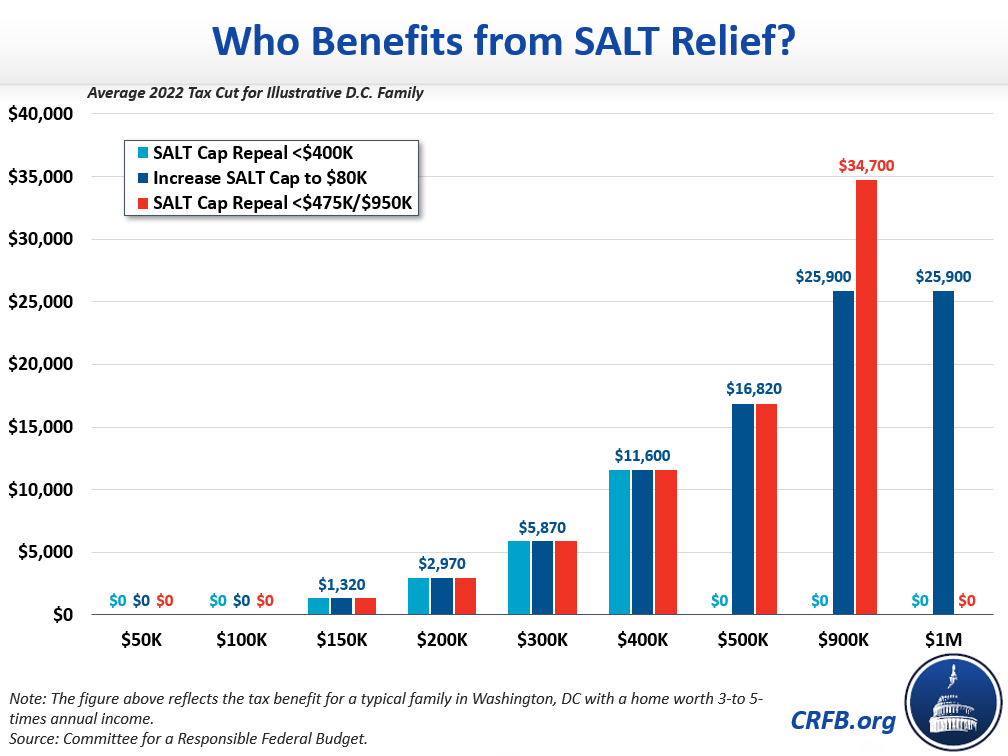

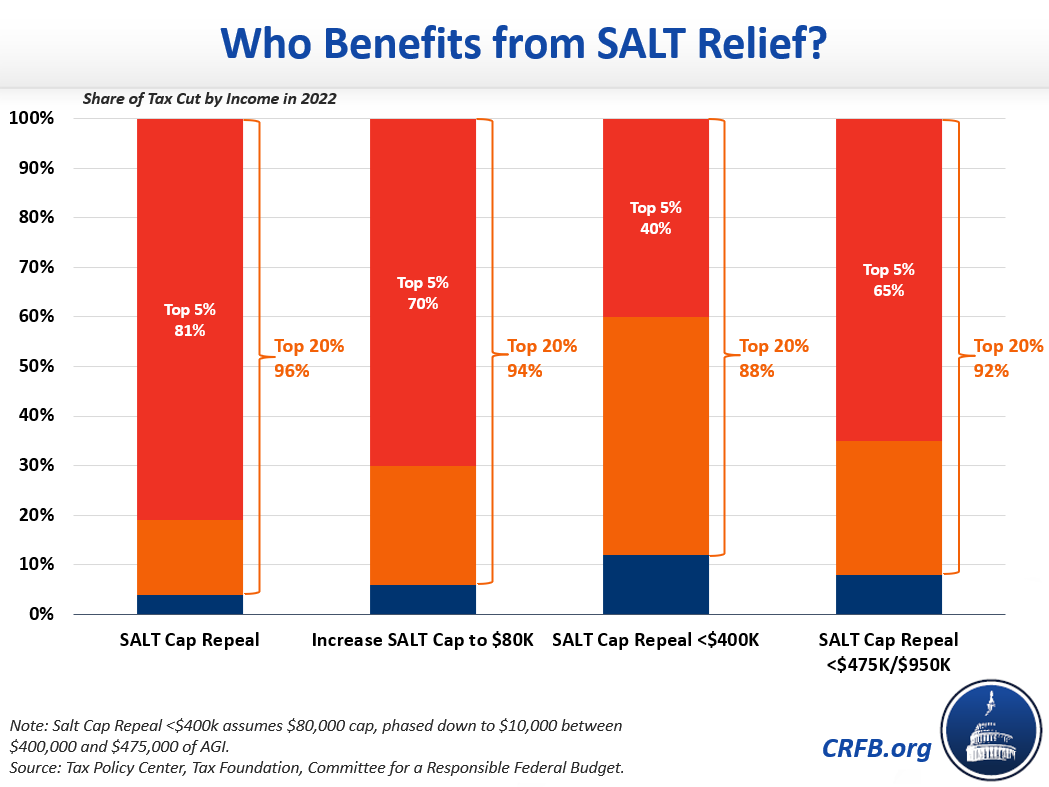

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

Utah State Tax Benefits Information

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth

States Sue Irs Treasury To Strike Down Salt Cap Under New Tax Law

Congress And The Salt Deduction The Cpa Journal

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Congress And The Salt Deduction The Cpa Journal

Understanding Salt Cap Workarounds Youtube

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Congress And The Salt Deduction The Cpa Journal

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget